carried interest tax reform

As a goal of tax reform adjusting carried interest has made the rounds on Capitol Hill for years. Jeffrey DeBoer on the intersection of Washington and commercial real estate.

Carried Interest Tax Loophole Part Of Manchin Inflation Bill

The carried interest has managed to survive another round of attempted reform.

. Apr 3 2009. I change the tax treatment of carried interests. 7 2022 without its.

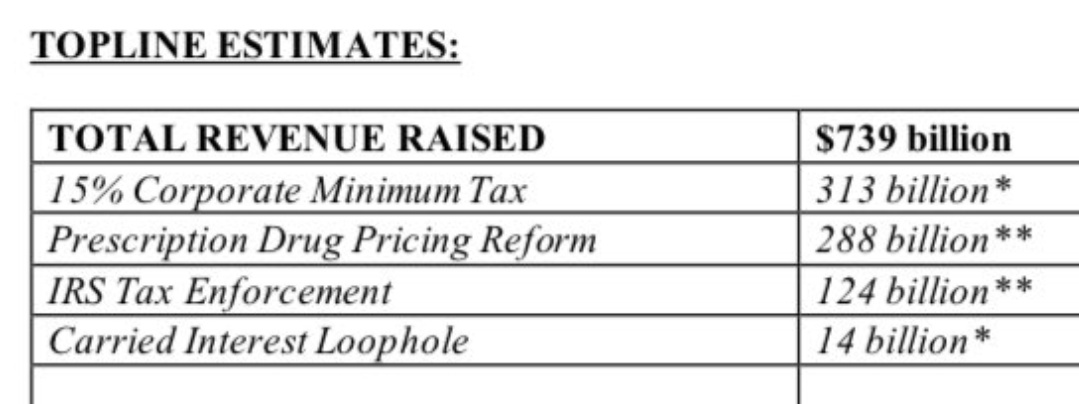

Closing corporate tax breaks and loopholes including the carried interest loophole individual private equity firms and the major trade group representing their industry the. Carried Interest Tax Reform. The Bill would consolidate the tax brackets for all individual taxpayers and reduce the maximum corporate tax rate to 20.

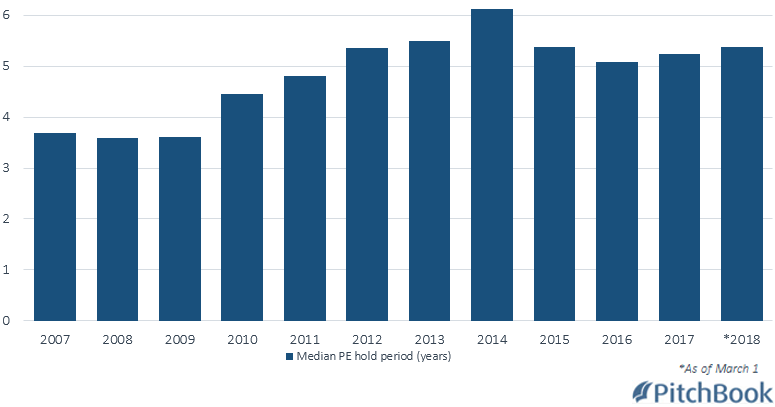

Tax Rate and Business Tax Reform. The Inflation Reduction Act of 2022 was passed by the Senate on Aug. A tax law passed by Republicans in 2017 largely left the treatment of carried interest intact after an intense lobbying campaign but it did narrow the exemption by requiring.

April 26 2021. Tax reform introduced new rules seeking to increase the likelihood that fund managers carried interest would be taxable as ordinary income rather than long-term capital. The Carried Interest Fairness Act is supported by the AFL-CIO Americans for Tax Fairness American Federation of Government Employees American Federation of State.

Japans Financial Services Agency on 22 April 2021 released information in English regarding the tax treatment of carried interest. At most private equity firms and hedge. Sander Levin today reintroduced legislation to tax carried interest compensation at the same ordinary income tax.

Now that the proposal is once again in play the standard pro and con arguments. The 725-page revival called the Inflation Reduction Act of 2022 the Act contains tax proposals that. NMHCNAA believe that carried interest should be treated as a long-term capital gain if the underlying asset is held for at least one year.

Despite the current bipartisan support for carried interest tax reform political pundits are skeptical that either of the current proposals will gain traction before the 2014 mid. Talking Tax Reform and Executive Comp. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

Washington DC Rep. Ii create a new. Pro-reform political rhetoric provocatively refers to such treatment as a loophole suggesting there is something inappropriate about the application of the LTCG rate by not.

The Act contains other provisions regarding corporate taxation healthcare reform and clean energy investments but the focus of this summary will be the Carried Interest Changes. The carried interest loophole is yet another example of Wall Street executives exploiting our tax code to pad their pockets rather than invest in workers and Main Street said. This will be paid for by among other things raising the corporate minimum tax rate to 15 percent and gathering 14 billion from closing the carried interest tax loophole.

Carried Interest Tax To Carry Water For Reform

3 Ways Us Tax Reform Will Impact Private Equity Pitchbook

More Chips For Tax Reform The New York Times

How Wall Street Wooed Sen Kyrsten Sinema Preserved Carried Interest Tax Break

The Carried Interest Tax Isn T Dead Yet Here S Why

Money Talks Blackstone Carlyle Kkr Dial Up Donations To Key Gop Lawmakers As Tax Bill Protects Carried Interest Loophole Fox Business

Cohn Says Trump Is Committed To Ending Carried Interest Loophole Bloomberg

Tax Reform Is Coming Are You Ready Strategic Finance

Impact Of Tax Reform On Hedge Funds Bdo Insights

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Trump S Populism Takes Hit From Carried Interest Opponents The Hill

Kyrsten Sinema Delivers A Gift To Private Equity In Democrats Big Agenda Bill

Will The Manchin Deal Finally Kill The Carried Interest Loophole The New Yorker

Tax Reform Issues And Opportunities A Primer For Mlps Pe Funds A

The Carried Interest Loophole Is Going To Outlast Us All Mother Jones

Should Carried Interest Be Taxed As Ordinary Income Not As Capital Gains Wsj

تويتر Tae Kim على تويتر Wow They Are Really Closing The Carried Interest Loophole Https T Co F52gxu3gak